One of the world's poorest regions is also home to the biggest natural-gas discoveries in a decade, luring investors from steel billionaire Lakshmi Mittal to Royal Dutch Shell Plc. (RDSA)

Eni SpA (ENI) and Anadarko Petroleum Corp. (APC) found about $800 billion of gas under the Indian Ocean off Mozambique, 36 times more valuable than the nation's economy, ranked 213 of 227 countries for per capita income. Explorers in neighboring Tanzania have struck gas fields, and drilling will pick up pace in Kenya this year.

The fields are big enough to support exports of liquefied natural gas, or LNG, opening up a source of energy supply to the world's fastest-growing major economies, India and China. They are also drawing the interest of the world's largest oil and gas companies, which prize LNG projects for their decades of generating cash. Exxon Mobil Corp. (XOM), Shell and BP Plc are the biggest owners of LNG capacity worldwide.

"East Africa is obviously very exciting after being a backwater for a long time," said Evan Calio, an oil and gas analyst at Morgan Stanley in New York. LNG plants are "big, capital-intensive projects. All the big ones want these."

Smaller explorers in the region are ready to do deals. Ophir Energy Plc, (OPHR) a London-based African specialist that counts the Mittal family and New York hedge fund Och-Ziff Capital Management Group LLC among its largest investors, says it's seeking partners to drill off Tanzania. Cove Energy Plc (COV), which holds a stake in Mozambique finds, said Jan. 5 it may sell the company. Anadarko Petroleum Corp. is looking to sell assets.

Buying Projects

The world's largest energy companies have been buying into projects to supply gas to customers in Asia. BP last year completed a $7.2 billion acquisition of a 30 percent stake in 21 Indian gas fields operated by Reliance Industries Ltd. Shell last year agreed to acquire an interest in the Chevron Corp.-led Wheatstone gas project in Western Australia.

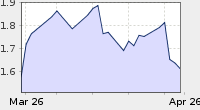

LNG prices in the Asian markets averaged between $16 and $17 per million British thermal units at the end of last year. In contrast, U.S. natural gas has dropped 43 percent in the last year and traded today at $2.556 per million British thermal units on the New York Mercantile Exchange at 7 a.m. local time.

'More Dominant'

"You'll see the majors becoming more dominant through acquisitions," said Stuart Joyner, an oil and gas analyst at Investec Securities in London. "A lot of the independents that really have been the vanguard in terms of opening the new province will sell out as things start to move out of the exploration stage."

While enough gas has been found to support the region's first LNG projects, there'll be no let-up in the hunt for resources in the region, which is under-explored compared with West Africa. Explorers have drilled fewer than 500 wells in East Africa and more than 33,000 through the rest of the continent, according to Afren Plc (AFR) data.

This year, 23 wells will be drilled off Kenya, Tanzania and Mozambique, almost double the number in 2011, according to research from Morgan Stanley.

"Assuming that the drilling success is continued you would expect to see consolidation around probably one mega-terminal" for Mozambique and one in Tanzania, Ophir Chief Executive Officer Nick Cooper said in an interview. "Obviously the bigger fish tend to eat the smaller fish."

BP had been in talks on East Africa projects with Ophir, while Shell teamed up with Petroleo Brasileiro SA (PETR4) in October to explore off Tanzania.

'Looking Closely'

"It's obviously a basin where many people of the world are looking closely," said Shell's executive director for exploration and production, Malcolm Brinded.

Tanzania, where Ophir's Cooper reckons exploration has lagged 18 months behind Mozambique, will be a focus of drilling this year. Ophir and its partner BG Group Plc (BG/) have so far found about 4 trillion cubic feet of gas in the East African country, where a per capita income of $1,400 ranks it 201st in the world, according to the Central Intelligence Agency's fact book.

Ophir, which is buying Dominion Petroleum Ltd., will be joined by Mubadala Oil & Gas of Abu Dhabi to explore Block 7 in Tanzania. The company plans to import LNG to meet the Persian Gulf nation's growing demand for gas.

"Strategically it's an interesting point," Cooper said. "It's the first real evidence of Gulf entities picking up acreage with the intention of taking gas into the Gulf."

Plans to Drill

Statoil ASA (STL), Norway's largest oil company, plans to drill a well this year at an exploration block in Tanzania where it's a partner with Exxon Mobil, CEO Helge Lund said. Statoil also has to drill at two exploration license areas in Mozambique before 2015. The "geographic location is almost perfect for LNG" shipments eastbound, Lund said.

Mozambique and Tanzania may eventually rival Qatar and Australia as the world's biggest suppliers of LNG, Investec's Joyner said. The East African deposits found so far are large enough to justify construction of at least eight LNG production trains, according to estimates by the companies. Today Qatar has 14 trains operating, while Australia has at least six trains producing and about $250 billion in projects under construction or planned.

Mambo Field

Eni, Italy's largest producer, will invest $50 billion to develop the 20 trillion-cubic-feet Mambo field off Mozambique's coast, CEO Paolo Scaroni said in December. "Our feeling is it would be a super-giant gas field and is well-placed to supply Asia by LNG," he said.

Anadarko is examining the possible sale of at least some of its holdings in the Mozambique discoveries, Chuck Meloy, a senior vice president of worldwide operations, said last month. The Woodlands, Texas-based company holds 36.5 percent of Mozambique's Area 1, which may yield as much as 30 trillion cubic feet of recoverable gas.

Cove, Anadarko's partner in the Rovuma Basin, is looking to sell the whole company. Analysts at UBS AG said Jan. 6 that BP, Statoil and Total SA (FP) are among the likely buyers.

The gas industry development will spur local economies, field and supply services. For example, Irish oil and gas engineering company Kentz Corp. is already pitching its products to East African explorers in anticipation of an LNG construction boom.

"That's a key opportunity," Kentz CEO Hugh O'Donnell said, referring to discoveries in Mozambique. "We are making it known to the people that it involves, what we are doing in Mozambique right now."

To contact the reporter on this story: Eduard Gismatullin in London at egismatullin@bloomberg.net

To contact the editor responsible for this story: Will Kennedy at wkennedy3@bloomberg.net

No comments:

Post a Comment