Our one-word choice for characterizing the offshore drilling industry during 2011 is stability. At the beginning of 2011 there were in total 517 floaters and jackups operating around the globe. Today, the number of rigs under contract is approaching 570 rigs. Backing out the fifty odd newest rigs that were scheduled for delivery in 2011 (18 ultra-deepwater drillships, 21 jackups, and 16 semisubmersibles) leaves a mature rig count under contract that only modestly budged between the beginning of 2011 and now.

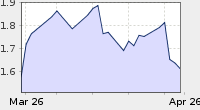

Looking specifically at dayrates, stability continues to hold as our buzzword. Heading into 2011, worldwide average dayrates were in the low-$230s. Entering 2012 dayrates have grown just slightly (i.e. averaging in the mid-$230s during 4Q11) from where the year began. Similarly, utilization trends are not much different now than on a global basis relative to the beginning of the year (73 percent in Dec. 2011 versus 71 percent in Dec. 2010).

Drilling down by both region and type of rig provides some interesting insights. For instance, dayrates for floaters operating in the Gulf of Mexico (GOM), now averaging in the low-$460s, are on par with pre-Macondo levels. And while currently there are four fewer ultra-deepwater rigs servicing the GOM, by May of 2012 rigs re-entering the region will push the fleet size back above levels seen before the oil spill.

Furthermore, according to our Riglogix database, GOM dayrates are expected to grow 9 percent annually to the high-$460s versus 2011's average annual rates. Also, the contracted GOM fleet is expected to grow 21 percent year-over-year to average 32 floater's servicing the region during 2012.

As illustrated in the preceding table, drilling off the coast of Africa experienced the greatest surge in activity during 2011. West Africa was the primary recipient of the additional deepwater rigs and some of the increase was caused by rigs displaced from GOM waters due to a lack of permitting. Latin America finished second with Brazil's quest to develop its vast offshore reserves as the primary impetus here.

With the exception of the GOM and SE Asia, dayrates for floaters increased slightly (or in many cases declined) throughout much of the world. Rigs that were on standby rates (due to permitting delays in the GOM) during 4Q10 skewed the average down for the region. Adjusting for the low base would have made the GOM look more like the rest of the world with respect to dayrates last year.

The count for jackups that were under contract or operating grew by 20 rigs or 6.5 percent during 2011. On average, the North Sea experienced the largest increase of shallow water activities last year, providing half of the global growth or ten additional jackups. An emphasis on redeveloping some more mature fields as well as a focus on deep gas discoveries were at the root of more activity in the region.

On average, shallow water dayrates declined globally nearly 5 percent during 2011. Looking across the regions; Australia, the Gulf of Mexico, and the North Sea bucked the downward trend. Harsh conditions and higher operating costs explain why drilling in both the North Sea and Australia is more expensive than average. And while improving nearly eight percent, the GOM jackup dayrates still have significant room for improvement to pricing achieved pre-Macondo. Unfortunately, the permitting environment continues at a slower pace than what would push rates dramatically higher any time soon in the region.

No comments:

Post a Comment