The year, which began with the Jan. 14 announcement of a landmark deal between Rosneft and BP, promised to be eventful to the very end. And it met expectations, as we were witness to the creation and collapse of strategic alliances, approval of new strategies, relocations and major projects. Much of what happened this year will set the stage for the future development not only of individual companies, but the entire sector as a whole.

Every Cloud Has a Silver Lining

Immediately after the New Year celebrations, state oil major Rosneft and Britain's BP surprised the whole oil community with the announcement of a strategic alliance that not only called for cooperation on the development of offshore fields on Russia's Arctic shelf, but also a share swap. Rosneft was supposed to get 5 percent of BP in exchange for 9.5 percent of its own shares.

But the companies did not even manage to begin discussing the details of the deal before BP's Russian partner in oil company TNK-BP (RTS: TNBP), the AAR consortium, challenged the deal. As a result of court injunctions prohibiting BP from holding any negotiations on cooperation with Rosneft, the deal was paralyzed and a few months later the companies had to call it off.

Nature abhors a vacuum, so Rosneft fairly quickly found a new foreign partner in U.S. major ExxonMobil, with which it concluded a strategic agreement at the end of the summer. However, the parameters of the alliance changed, with the companies agreeing on the joint development of offshore fields in the Arctic with resources of 4.5 million tonnes of oil and 11 trillion cubic meters of gas, but refraining from a share swap. In addition, Rosneft gained potential access to ExxonMobil deepwater exploration projects in the Gulf of Mexico and the development of fields with difficult to recover reserves in Texas.

Four months have passed since the deal was signed, but the companies have not disclosed any new details. Rosneft expects to decide what ExxonMobil projects it might be interested in by the first quarter of 2012. If the partners are unable to decide by March, the process might be delayed due to a reshuffle after the Russian presidential elections.

A New Take on Life

Despite the continued ban on access to Russia's continental shelf, drilling delays in Iraq and so far unimpressive exploration results in West Africa, Lukoil (RTS: LKOH) is optimistic about the future and its new long-term strategy is set on increasing production. Oil and gas production is targeted to grow by an annual average of at least 3.5 percent over the next ten years.

The company plans to be producing 110 million tonnes of oil and over 40 bcm of gas per year in ten years. Most of this growth is expected to come from prospective projects in Iraq, Central Asia, the Caspian and the Yamalo-Nenets Autonomous District. The company will focus on new technologies that will enable it to increase the oil recovery rate from 32 percent to 40 percent, adding 9 billion barrels to its resource base. The company plans to invest more than $100 billion over ten years, including $24 billion in its downstream business.

The company also plans to increase dividends over this period and in future they could amount to about 30 percent of net profit to US GAAP.

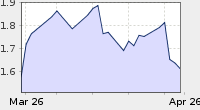

Being a significant player not only on the Russian, but also the international oil and gas market, Lukoil has been unable to get a fair valuation of its shares, which it thinks are considerably undervalued. Perhaps the presentation and subsequent implementation of the new strategy will bring Lukoil closer to the prized market capitalization threshold of $100 billion.

Grass is Grenner ...

The most significant event in the corporate life of Gazprom Neft (RTS: SIBN) in 2011 was the relocation of the company's head office from Moscow to St. Petersburg. It's not often that a major company moves from the capital to another city with one sweep. The move was the conclusion of the company's "relocation" - back in 2005, when Gazprom (RTS: GAZP) bought Sibneft and later renamed its Gazprom Neft, it was announced that the oil company would be reregistered from Omsk to St. Petersburg.

The move was accompanied by a management reshuffle and general intra-company stress. There was even talk that Gazprom Neft head Alexander Dyukov, though himself a native of St. Petersburg, was in no hurry to move there permanently. The intrigue around Dyukov intensified as his contract expired late in the year. However, Gazprom Neft's board will discuss the contract with the chief executive on December 29, and the only candidate is Dyukov.

Hard-Won Refining

The past year was a mixed bag for Tatneft (RTS: TATN). On one hand, the company had to suspend operations in Libya and Syria, but on the other it brought its first oil refinery on line commercially. However, the refinery project did not go quite as smoothly as the company had hoped.

Refining has long been a missing link in Tatneft's production chain. The company exports most of its oil and buys oil products to supply its filling stations.

The Taneco refinery project was launched at the end of 2007, and in October 2010 the company announced it had completed construction and installation work at the primarily refining facility and launched the plant. But as it turned out, only on a testing and commissioning basis. It took Tatneft another year in order to obtain all the necessary licenses and put the refinery into commercial operation.

The refinery was initially expected to have capacity of 7 million tonnes of crude per year, but later the company announced plans to build a second phase with the same capacity.

However, by the time the first phase of the refinery came on line commercially, the Russian government sprang an unpleasant surprise on Tatneft - the 60/66 tax regime, which dramatically reduces the profitability of exporting dark oil products, while Taneco at this point can only produce raw gasoline, fuel oil and heating oil.

The company's expectation that it would begin the second phase of the refinery this year in order to increase production of dark oil products and accelerate the recovery of investment was disappointed and it is now betting on deepening refining. The company expects to produce its first gasoline in 18 months.

Tatneft estimated it would lose 34 billion rubles in revenue as a result of the new tax regime and received corresponding compensation from the government. But Tatneft itself will not get the compensation - the concession will be transmitted to the TAIF-NK oil refinery, a member of the TAIF Group, by lowering the cost of the crude shipped to the refinery. Furthermore, the reduction of export duties on crude oil under the 60/66 regime benefits Tatneft, which exports most of its crude.

In 2011 Tatneft finally became a full-fledged vertically integrated company. But at what price? Since the launch of the Taneco project, Tatneft's long-term and short-term debt has grown nearly ten-fold. In the coming year the company will need to repay or refinance more than 80 billion rubles, plus invest about 20 billion rubles in Taneco.

How Tatneft will raise the cash - by selling production assets, a stake in Taneco or new borrowing - will become evident in 2012.

Copyright 2011 Interfax News Agency. All Rights Reserved.

No comments:

Post a Comment